Understanding Liquid Staking

Liquid staking is an innovative concept in the cryptocurrency realm, merging aspects of traditional staking frameworks with enhanced liquidity solutions. Unlike conventional staking, where crypto assets are typically locked away to support network security and become unavailable until the staking period ends, liquid staking introduces a novel method. It allows users to stake their assets while simultaneously receiving a tokenized counterpart of their staked holdings, often referred to as 'liquid staking tokens' or LSTs. These tokens can afterward be freely traded, transferred, or even used on decentralized finance (DeFi) platforms, thereby adding further utility without forfeiting staking rewards.

The essence of liquid staking lies in its capacity to reduce the opportunity costs associated with traditional staking. By offering participants liquidity, it enables them to engage in various financial pursuits. This model provides stakeholders the flexibility to seize emerging investment opportunities within the crypto space without needing to redeem their original holdings, which might otherwise result in situations like foregoing rewards during mandatory lock-up periods.

Furthermore, liquid staking signifies a significant step towards decentralization and wider participation, as it lowers the entry barriers for smaller investors who can now engage in staking pools. Discover our guide to decentralized staking for more insights into how this democratizes the process. This democratic feature enhances network security by potentially boosting validator involvement, dispersing influence within a more diverse community. By offering a seamless fusion of passive income generation and liquidity retention, liquid staking represents a groundbreaking progression in expanding the practicality of digital currencies. Learn about the benefits of liquid staking with Lido to explore its innovative impact further. Consulting specific materials like comprehensive analyses on the merits of liquid staking could provide more profound insights into its implications and potential for future growth within the financial domain.

How Liquid Staking Works

Liquid staking signifies a nuanced transformation from traditional staking models, offering a more adaptable pathway for cryptocurrency staking. At its core, liquid staking addresses the rigidity often associated with the staking process by introducing fluidity to the ecosystem. This innovation markedly reimagines the staking landscape by enabling participants to stake their assets without surrendering access to their liquidity.

The essence of liquid staking resides in the framework that allows users to maintain the effectiveness of their staked assets. Unlike conventional staking, where assets are confined for fixed durations, liquid staking provides users with derivative tokens that represent their staked assets. These derivative tokens can subsequently be traded, transferred, or utilized in other decentralized finance endeavors. This enhanced interchangeability is particularly beneficial for investors keen to capitalize on other market opportunities without losing staking rewards. Discover our guide to decentralized staking for more insights.

From an operational standpoint, the process generally entails a smart contract platform that adeptly manages the staking operation. When committing their assets, users receive derivative tokens on an equal-value basis, representing their staked assets. The original tokens remain locked in the staking mechanism, enhancing network security and transaction validation while accumulating rewards over time. Meanwhile, the derivative tokens allocated to holders can often be employed in various financial instruments, from lending options to yield optimization activities, further amplifying their utility and potential returns.

Liquid staking enhances adaptability and capital efficiency by reducing the opportunity costs associated with conventional, non-liquid staking structures. Its implementation lowers the barriers to staking entry and exit, enabling more sophisticated financial strategies, alleviating passive income constraints, and transforming staking into a more dynamic investment approach. Consequently, participants can achieve greater financial flexibility while still supporting the fundamental operations that sustain blockchain networks. Learn about the benefits of liquid staking with Lido for a deeper understanding of how this innovation can work in practice.

Benefits of Liquid Staking

Liquid staking provides a groundbreaking avenue for staking digital assets, offering intricate advantages that exceed traditional methods. Unlike conventional staking, where assets are locked away for specific periods, liquid staking offers unparalleled flexibility by allowing stakers to retain liquidity. This enables users to stake their assets while simultaneously engaging in other financial pursuits, thus maximizing capital efficiency. Moreover, liquid staking presents a refined approach to risk management. It reduces the opportunity cost associated with holding staked tokens by allowing participants to trade their staked assets in secondary markets. Such dexterity enhances market involvement and promotes a more dynamic staking ecosystem.

Additionally, liquid staking is revolutionary in making access to staking rewards more fair, allowing even small-scale investors to participate in network benefits without the usual size limitations. This inclusiveness expands the staking community and hastens decentralization. Furthermore, through the integration of automated processes and smart contract technologies, liquid staking often enhances security and transparency, building robust defenses against potential weaknesses common in traditional staking pools.

In conclusion, the emergence of liquid staking represents a transformative shift in the paradigm; it aligns the quest for passive income with the flexibility of active asset management, propelling both novice and experienced participants toward a more adaptable and resilient decentralized finance ecosystem. Discover our guide to decentralized staking to understand more about these innovations and learn about the benefits of liquid staking with Lido to explore specific advantages offered by leading platforms.

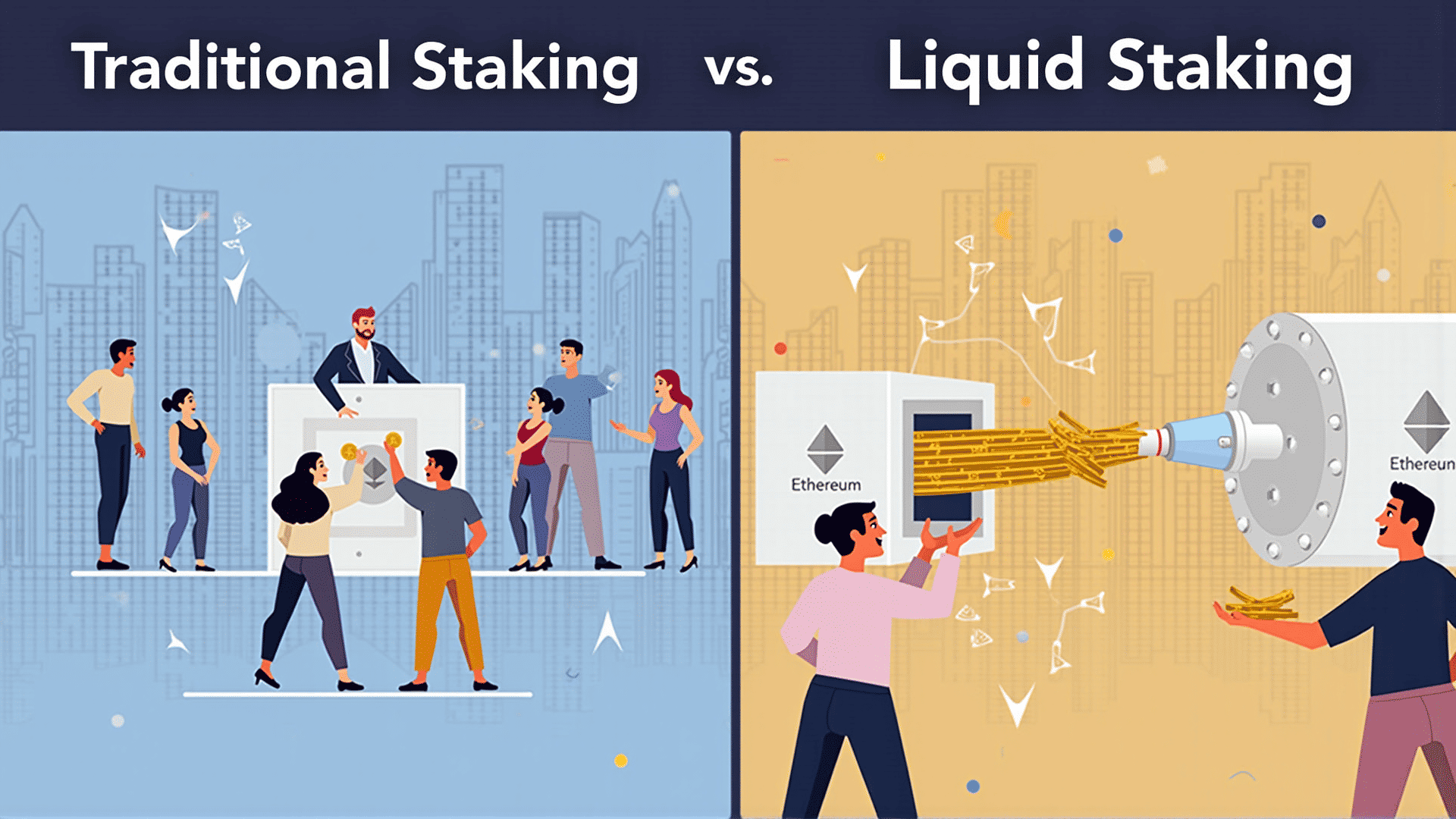

Comparing Liquid and Traditional Staking

Delve into the schism between liquid and traditional staking, and you'll uncover distinct paradigms shaping the metamorphosing staking landscape. In the conventional staking model, participants segregate a designated quantity of cryptocurrency in a network repository to enhance blockchain security and network operations, earning rewards in a straightforward yet inflexible manner. This traditional approach is often burdened with the constraint of asset immobilization—a significant factor for participants who may wish to maintain liquidity for alternative investment pursuits or market strategies.

In stark contrast, liquid staking emerges as an innovative approach that blends the security and reward benefits of traditional staking with the highly coveted flexibility of liquidity. Participants choosing liquid staking contribute their assets to a decentralized pool, receiving tokenized derivatives in return. These derivatives mirror a participant's staked amount, enabling them to trade, invest, or engage with other decentralized finance mechanisms while still accruing staking rewards.

Discover our guide to decentralized staking to explore more about these models. The dual-faceted benefit proposition of liquid staking introduces a two-tier financial engagement: one where stakeholders can enhance yield through traditional staking rewards and another where they leverage the liquidity of their derivatives for further asset utilization. However, liquid staking is not without complexities. Participants must consider potential risks such as smart contract vulnerabilities and the complexities of derivative value fluctuations in secondary markets.

Whether the allure lies in the concrete reliability of traditional staking or the dynamic potential offered by liquid staking, grasping both models empowers stakeholders to align their strategies with broader financial aspirations and risk management.

The Future of Liquid Staking

As the DeFi ecosystem evolves, liquid staking has arisen as a cutting-edge innovation, addressing certain inherent liquidity limitations encountered in conventional staking methods. This strategy, instead of indefinitely sequestering assets, enables users to maintain flexibility in their portfolio by trading staking derivatives. These derivatives symbolize the staked assets and can be utilized within various decentralized applications, thus avoiding the immobilization typically observed in standard staking protocols.

The potential growth path for liquid staking is intricately linked to both the maturation of blockchain networks and the transformation of regulatory landscapes. With Ethereum's transition to a proof-of-stake model, liquid staking finds a fertile ground for expansion. The quest for yield improvement, along with a preference for novel risk strategies, drives this burgeoning trend. Moreover, as interoperability across blockchains advances, users can access cross-chain staking assets, diversifying risk and maximizing returns.

Institutional investors, who are frequently cautious of the illiquidity inherent in staking, may be enticed by liquid staking's blend of liquidity and returns, accelerating its mainstream traction. Furthermore, advances in technology—and potential breakthroughs in zero-knowledge proofs and scalable oracle solutions—might address security challenges, establishing liquid staking as an essential element of decentralized finance.

Nevertheless, the journey toward widespread acceptance is not devoid of hurdles. Market players need to navigate the intricate terrain of protocol-specific hazards, such as vulnerabilities in smart contracts and possible governance shortcomings, which could obstruct the expected growth. The development of liquid staking, consequently, demands nimble adaptation to the continually shifting crypto environment and its elaborate requirements, positioning it as both an enticing opportunity and a formidable challenge within the larger narrative of financial decentralization.